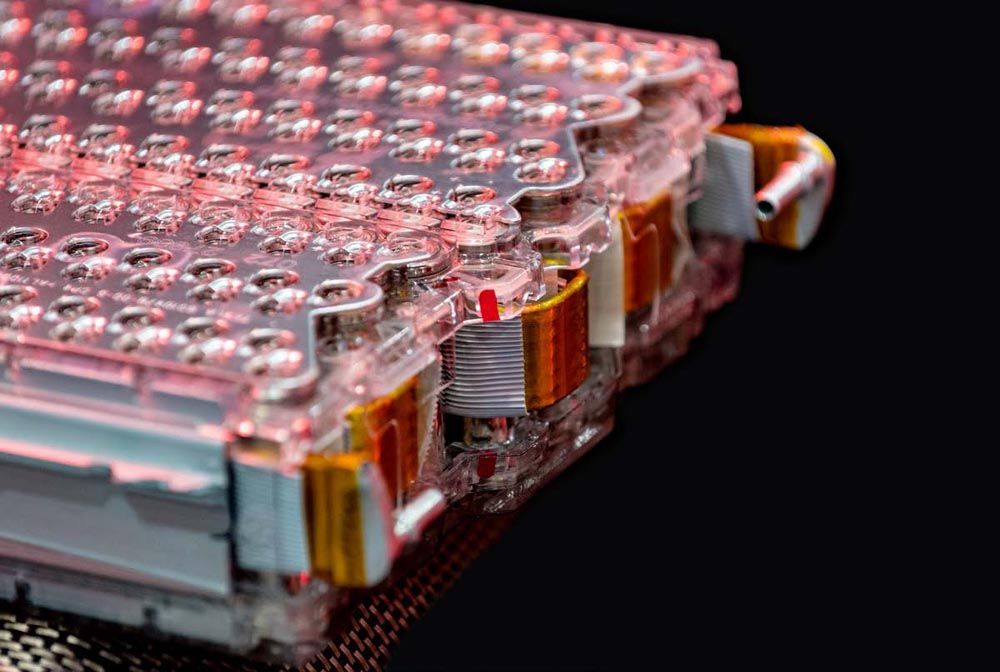

LFP, embraced by EV industry leader Tesla two years ago, has sparked new interest especially in the United States, where a clutch of domestic and overseas manufacturers has pledged more than $11 billion in new production facilities.

Toyota Motor and Hyundai Motor, have both recently announced plans to equip their future vehicles with LFP batteries.

Michigan-based Our Next Energy—a proponent of LFP according to founder and chief executive Mujeeb Ijaz—is building a $1.6 billion battery manufacturing complex in Van Buren Township because the materials are more abundant and sustainable, with far less risk of fire. “We’ve also demonstrated that you can match the range of cobalt cells with no compromise,” he said.

More than 90 percent of LFP materials and components still come from China, said battery expert Shirley Meng, a University of Chicago professor, and head of Argonne National Laboratory’s Collaborative Center for Energy Storage Science.

The rapidly increasing adoption of LFP by EV manufacturers including Tesla and Hyundai suggests those companies “are not ready to decouple from China," Meng said.

Earlier this year, Michael Matz wrote an article for Argonne National Laboratory titled, “Investigating battery failure to engineer better batteries.” This study explored how a class of gemstone materials could be a key ingredient in next-generation batteries. The research team included the US Department of Energy’s (DOE) Argonne National Laboratory, DOE’s Oak Ridge National Laboratory, Princeton University and Purdue University. The study used cutting-edge X-ray techniques at Argonne’s Advanced Photon Source, a DOE Office of Science user facility.

Michigan Tech University has also been in the news this year for transportation and sustainability endeavors.

“Michigan Tech is committed to advancing new technology and sustainability solutions—in its work on campus at the Keweenaw Research Center and Great Lakes Research Center, in the Grand Traverse region with the Freshwater Research and Innovation Center, and in Ann Arbor at the Michigan Tech Research Institute. These impressive footprints strongly position the University and its talent throughout the state. The mobility industry provides an annual economic contribution to the state of Michigan of over $300 billion. It is our signature industry,” said Glenn Stevens Jr., executive director, MICHauto.

Early 2023, the DOE awarded grants to develop rapid carbon mineralization and critical mineral extraction technology to 16 projects nationwide, totaling $39 million. Michigan Tech’s project is the only one in the state of Michigan to receive funding from Mining Innovations for Negative Emissions Resource Recovery (MINER), a new initiative through the DOE’s Advanced Research Projects Agency-Energy (ARPA-E). The MINER initiative funds technology research that increases mineral yield, while decreasing required energy and subsequent emissions, to mine and extract energy-relevant minerals.

Michigan Tech’s project is titled “Energy Reduction and Improved Critical Mineral Recovery from Low-Grade Disseminated Sulfide Deposits and Mine Tailings.” It seeks to permanently and cleanly mineralize and store carbon dioxide, potentially enabling the mining industry in Michigan’s Upper Peninsula and Minnesota to achieve net carbon zero while extracting critical minerals from low-grade ores, said principal project investigator (PI) Lei Pan, an associate professor in Michigan Tech’s Department of Chemical Engineering.

A copper mine located in British Columbia, Canada.

The American Three: Motors, Miners and E-Mobility

This focus on battery minerals has led GM, Ford and Stellantis to partner with a variety of suppliers to support battery production in North America.

Ford Motor aims to open a $3.5 billion LFP cell manufacturing plant in western Michigan, leveraging technology licensed from China’s CATL, the world’s largest EV battery maker. The goal, Ford CEO Jim Farley said in a press release, is to lower the automaker’s cell costs to less than $70 a kilowatt-hour, from more than $100/kWh for current NCM cells.

Stellantis and Canada-based miner NioCorp Developments Ltd (NB.TO) recently signed a supply deal for rare earth minerals critical to electrical vehicles. The preliminary agreement establishes a 10-year offtake contract for minerals like neodymium-praseodymium oxide, dysprosium oxide, and terbium oxide that NioCorp aims to produce at its Elk Creek Critical Minerals Project in southeast Nebraska.

General Motors and Element 25 Limited announced an agreement for Element 25 to supply up to 32,500 metric tons of manganese sulfate annually to support the annual production of more than 1 million GM EVs in North America.

Under the agreement, GM will provide Element 25 with an $85 million loan to partially fund the construction of a new facility in the state of Louisiana for production of battery-grade manganese sulfate—a key component in lithium-ion battery cathodes—starting in 2025. Element 25 will produce manganese sulfate at the facility by processing manganese concentrate from its mining operations in Australia. It is expected to be the first facility of its kind in the United States.

“GM is scaling EV production in North America well past 1 million units annually and our direct investments in battery raw materials, processing and components for EVs are providing certainty of supply, favorable commercial terms and thousands of new jobs, especially in the United States, Canada and free trade agreement countries like Australia,” said Doug Parks, GM executive vice president, global product development, purchasing and supply chain. "The facility E25 will build in Louisiana is significant because it's expected be the first plant in the United States to produce battery-grade manganese sulfate, a key component of cathode active material which helps improve EV battery cell cost."

A Renewed Focus

Minerals for battery production exist here in North America just as they do around the globe. Today, it’s a question of building the production facilities, infrastructure, and supply chain to onshore these processes here at home. According to the International Energy Agency (IEA), mineral demand will likely triple by 2040. The transportation industry can debate electric vehicles, charging requirements, battery costs and regulations, etc., but without the minerals to power these batteries it won’t matter—North America’s clean energy ambitions will come down to building (and digging) its own e-mobility roadmap.

An abandoned mine in Michigan’s Upper Peninsula may still hold raw materials for North America’s clean energy future.

Additional Resources

Interested in learning more about the mineral arms race? Check out the following resources:

Ewing, J., Krauss, C., “Lithium Scarcity Pushes Carmakers into the Mining Business,” The New York Times, July 2, 2023.

Bednarski, L., 2021, Lithium: The Global Race for Battery Dominance and the New Energy Revolution.

Pitron, G., 2020, The Rare Metals War: The Dark Side of Clean Energy and Digital Technologies.

Bridges, A., Mamula, N., 2018, Groundbreaking! America’s New Quest for Mineral Independence.

anl.gov

ornl.gov

rmi.org